529 plans have long been the preferred option for parents, grandparents, and investors alike to fund qualified education expenses. While this isn’t likely to change, a recent decision in Washington, D.C. has changed the game and unlocked a unique opportunity for those saving into 529 plans with Secure Act 2.0. Beginning in 2024, 529 plan owners can roll funds from their 529 plan into their child’s Roth IRA without paying taxes or penalties. For brevity’s sake I will use the term “child” but you can substitute grandchild, niece, etc. and everything below still applies. They can roll over a total of $35,000 to the Roth IRA of the child in increments of the annual Roth IRA contribution limit, which is currently $6,500.

There are more stipulations which we will get to in a bit below, but you may be thinking why does a $35,000 lifetime limit constitute as a “game changer?” Well, for starters, those parents or grandparents who have excess dollars in the 529 accounts they opened years ago now have another potential option for the excess funds rather than paying a 10% penalty as well as ordinary income tax on the gains within the account. They can now kickstart, or further fund, the child’s future retirement.

Before we get into unique opportunity this may provide, we need to address some of the constraints. The SECURE Act 2.0 outlines the following constraints must be met and adhered to:

- There is a lifetime cap of $35,000 that can be rolled over

- The maximum annual rollover amount is the annual contribution limit for that year (currently $6,500)

- The 529 account must have been open for at least 15 years

- You cannot roll over contributions placed into the account within the last 5 years

Now that those are addressed, we can talk about the potential big winners from this. The big winners, the ones who are the beneficiaries of this “game changer,” are those that are still funding their child’s 529 plan, especially for young children. Not only does this new rule provide a bit more comfort to those who are worried about “overfunding” their child’s future education, but it has actually opened up a unique opportunity to pass on considerable levels of wealth (tax free that is!) to your loved ones and future generations.

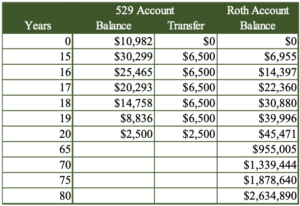

Let’s say that a parent opens up a 529 account for their child in the year that they were born. If we assume that they are planning on saving to fund their child’s future education, those contributions are set up, and that their cash flow or savings permits, they could opt to “overfund” in the first year, or first couple of years, to try to have enough to also take advantage of this rollover when the child is 15 years old (15th year of account being opened.) Knowing that that the account has at least 15 years to be invested, really 20 if you consider you can’t roll all $35,000 over in one year (subject to annual contribution limits), a lump sum contribution of just below $11,000 could turn into nearly $1,000,000 in Roth money for your child by the time they are 65 years old (and this is tax free!) The more detailed math is in the table below assuming a 7% annualized return.

It is important to note as well that 529 accounts grow tax deferred, unlike traditional brokerage accounts where you pay taxes on dividends and realized capital gains along the way, allowing for more effective investment growth during the accumulation phase of the 529 plan.

Doing this certainly takes planning and an eye on the long term, but the potential impact saving of strategically saving up to $11,000 now is remarkable. This does not account for the fact that depending on the parents’ situation, this also is a way to pass money to future generations out of their estate, bypassing potential estate taxes if applicable.

So, what are the risks? The primary risk is that another piece of legislature comes along in the future, eliminating this opportunity, or restricting it further, and the 529 account has more in it than is necessary to meet desired education expenses. In this scenario, if there are no other eligible beneficiaries to transfer those funds too, or no future generations, then we are just back where we started, and any excess taken out for non-qualified education expenses is subject to the 10% penalty and ordinary income taxes on the gains. While there are no guarantees, and there is no use in speculating on future tax law, even if the laws did change in the future, it would be hard to imagine funds being removed from a Roth IRA, once rolled over, assuming all the requirements were met.

The bottom line is that the Secure Act 2.0 has now presented a unique opportunity for those who save using 529 funds. If you have excess 529 funds, or you want to begin the process of funding a legacy for your loved ones today, we are excited to help you on this journey!

Investors should also consider whether the investor’s or beneficiary’s home state offers any state tax or other benefits available only from that state’s 529 Plan. Any state-based benefit should be one of many appropriately weighted factors in making an investment decision. The investor should consult their financial or tax advisor before investment in any state’s 529 Plan.